Cryptocurrency analyst and trader Ali Martinez is saying that a leading Ethereum (ETH)-based decentralized exchange could be on the cusp of making a significant upside move.

Martinez tells his 33,200 followers on the social media platform X that Uniswap (UNI) “appears to be breaking out” on the weekly chart after invalidating a descending triangle.

A descending triangle is typically considered a bearish continuation pattern.

According to Martinez, if Uniswap prints a “sustained close” above the price of $5.70, UNI could soar toward $10, a gain of around 62% from the current price.

Uniswap is trading at $6.18 at time of writing.

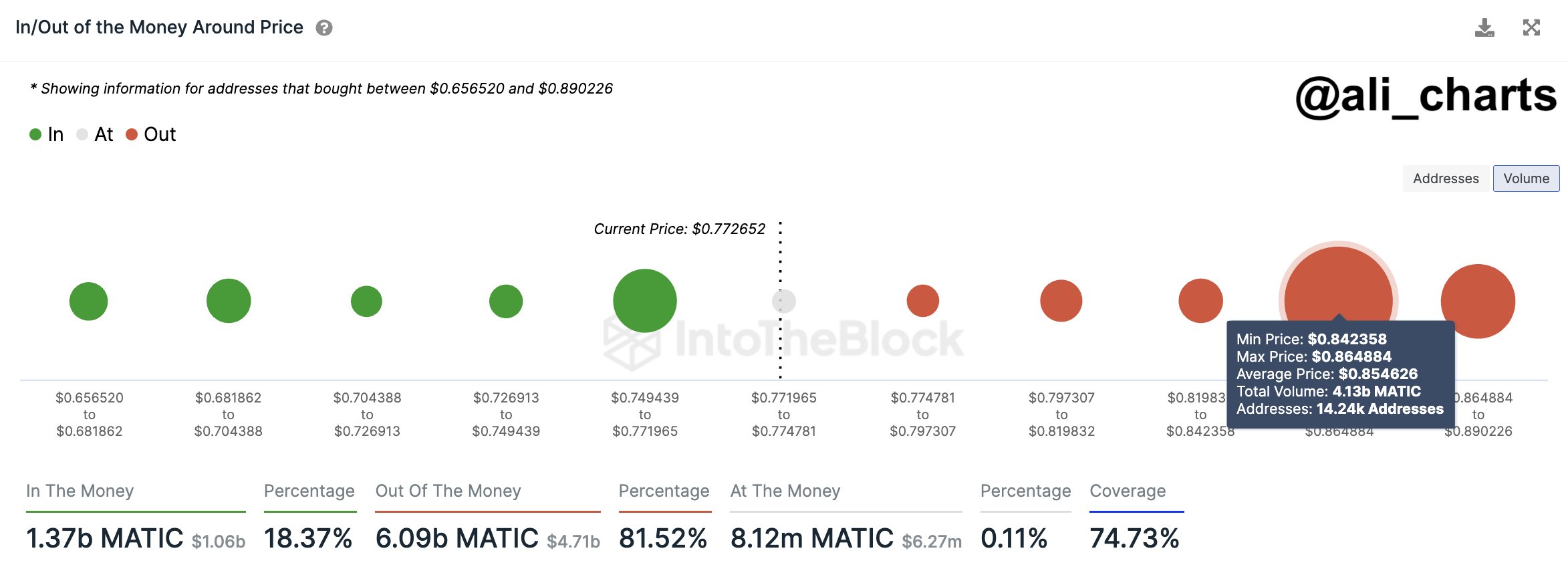

Turning to Polygon (MATIC), Martinez says that the Ethereum scaling solution could witness a sell-off if it fails to break above a crucial price level.

“MATIC has slipped below a crucial supply zone, spanning $0.84 to $0.86. In this range, 14,240 addresses hold over 4.13 billion MATIC.

The longer the Polygon price remains below this zone, the higher the likelihood that these holders might start selling to avoid incurring significant losses.”

MATIC is trading at $0.772 at time of writing, well below Martinez’s supply area.

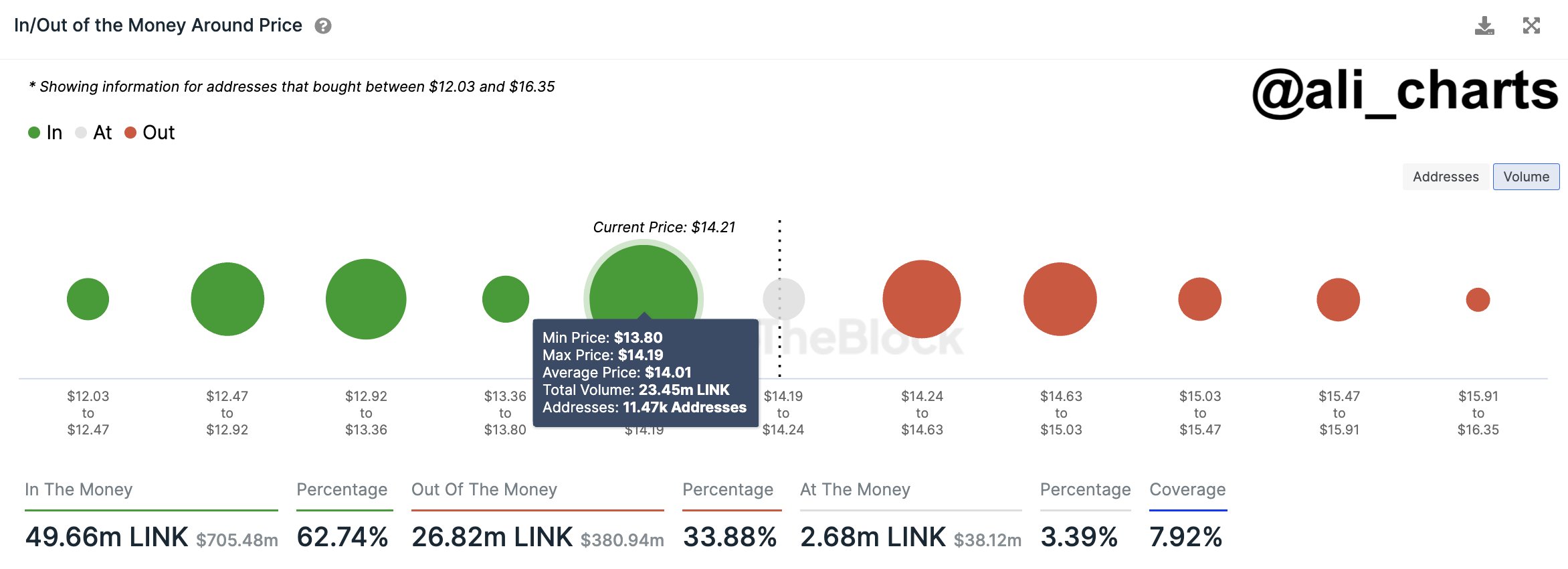

Next up is the blockchain oracle Chainlink (LINK). The crypto analyst and trader says that Chainlink could revisit and surpass the 2023 high of $16.62.

“Chainlink is in a key demand zone, ranging between $13.80 and $14.20. Here, 11,470 wallets hold a substantial 23.5 million LINK.

With minimal resistance ahead and solid support below, remaining above this zone could pave the way for LINK to climb to new yearly highs.”

Chainlink is trading at $14.34 at time of writing.

Turning to XRP, Martinez says that the fifth-largest crypto asset by market cap could rally between $0.65 and $0.66 as it seems to be breaking out from the range midpoint of a descending parallel channel.

In technical analysis, descending parallel channels are typically considered bearish, but an asset may still rally to the top of the structure’s range as Martinez’s chart suggests.

XRP is trading at $0.612 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Giovanni Cancemi/Natalia Siiatovskaia