Ripple publishes the quarterly XRP Markets Report to voluntarily provide transparency and regular updates on the company’s views on the state of the XRP market, including quarterly programmatic and institutional sales updates, relevant XRP-related announcements, such as Xpring and RippleNet partnerships, and commentary on previous quarter market developments.

As an XRP holder, Ripple believes proactive communication and transparency are part of being a responsible stakeholder. Moreover, Ripple urges others in the industry to follow its lead to build trust, foster open communication and raise the bar, industry-wide.

Disciplined, Responsible Stakeholders: Continued Pause in XRP Programmatic Sales

In Q2 2020, total XRP sales were $32.55 million (USD) vs. $1.75 million the previous quarter. Ripple continued the pause of programmatic sales, focusing solely on its over-the-counter (OTC) sales as part of providing increased XRP liquidity to RippleNet’s On-Demand Liquidity (ODL) customers. This added liquidity is vital as ODL continues to evolve and expand into new corridors.

A healthy, orderly XRP market is required to minimize cost and risk for customers, and Ripple plays a responsible role in the liquidity process. As more financial institutions leverage RippleNet’s ODL service, more liquidity is added into the XRP market. That said, Ripple has been a buyer in the secondary market and may continue to undertake purchases in the future at market prices.

Total sales (OTC-only, given programmatic pause) ended the quarter at 18 bps of CryptoCompare TopTier volumes. This is compared to total sales in the previous quarter (OTC-only, given programmatic pause) of 0.60 bps of CryptoCompare TopTier.

| Sales Summary (dollars in millions) | Q1 2020 | Q2 2020 |

|---|---|---|

| Institutional direct sales (OTC) | 1.75 | 32.55 |

| Programmatic sales | 0 | 0 |

| Total sales | 1.75 | 32.55 |

| Global XRP volume | Q1 2020 | Q2 2020 |

|---|---|---|

| ADV XRP (dollars in millions)** | 322.66 | 196.28 |

| Total XRP volume (dollars in billions) | 29.68 | 17.86 |

| Total sales as % of total volume | 0.006%* | 0.18%* |

* Percentage is calculated by dividing actual Ripple dollar proceeds by total reported XRP volume in dollars.

**Note: Figures were compiled using the CryptoCompare API for daily TopTier aggregate volumes which reflects total XRP volume in dollars by exchanges that CryptoCompare lists in the TopTier as of the end of Q2. Ripple continues to evaluate its benchmarks given challenges, such as fake volume, that continue to persist in the industry.

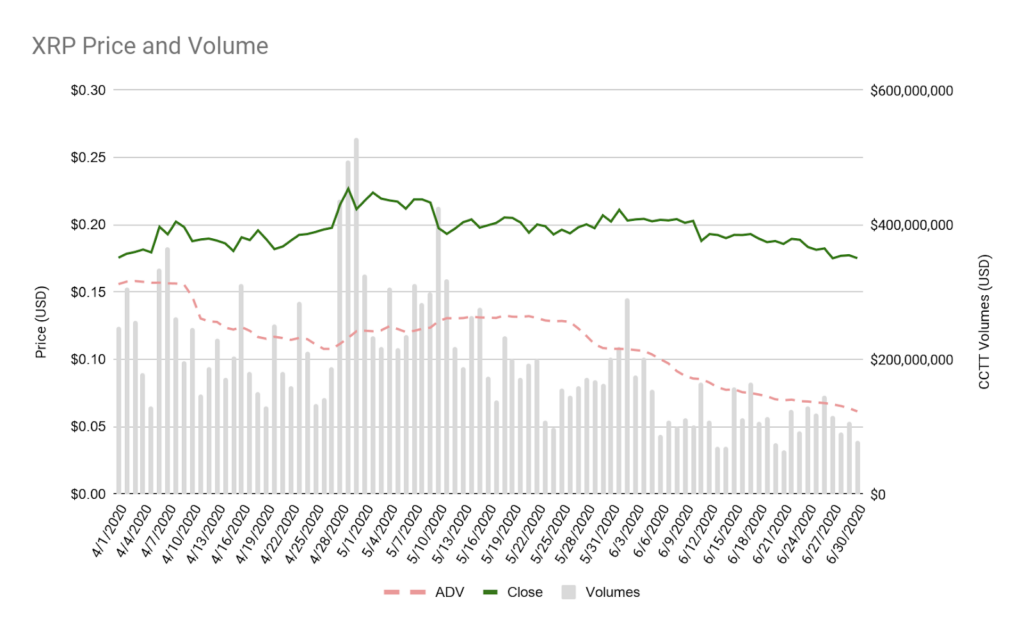

CCTT’s reported daily volume for XRP decreased in Q2 2020 from Q1 2020. The average daily volume reported at $196.28 million in Q2 versus $322.66 million in Q1.

Volatility

XRP’s standard deviation of daily returns over Q2 was 3.0%, representing a decrease in volatility from Q1’s 6.2%. XRP’s volatility over the quarter was lower than that of bitcoin (3.4%), and lower than that of Ethereum (4.2%).

Escrow

In Q2 2020, three billion XRP were released out of escrow (one billion each month). In total across the quarter, 2.6 billion XRP were returned and subsequently put into new escrow contracts. For more information on the escrow process, see here. Note: All figures are reported based on transactions executed during the quarter.

On-Demand Liquidity (ODL)

More than ever, financial institutions are seeing the value of RippleNet’s ODL service to provide instant, global payments and meet market demand, especially during times of crisis due to the exposed risk and increased volatility. In Q2 2020, ODL accounted for nearly 20% of RippleNet volume. Comparing just H1 2019 with H1 2020, RippleNet experienced 11x year-over-year growth in ODL transaction volume.

Early on, Ripple identified remittances as its primary use case, and will continue to focus on supporting low-value, high-frequency payments with ODL. Ripple is reducing its emphasis on large treasury payments—which are traditionally used to fund businesses and services in the absence of real-time transfers—to support individual, low-value transactions, addressing the growing need in remittances and small- and medium-sized enterprise payments.

XRP Integrations and Liquidity Update

XRP Integrations

The development of liquid and robust markets is key to the success of ODL. The second quarter of 2020 saw numerous integrations that helped contribute to the health of XRP markets. Of note, Binance launched XRP exchange-traded options contracts. In the derivatives space, XRP perpetuals are now found on all of the top five derivative venues after Huobi DM’s launch of XRP perpetuals in April 2020.

Additional notable integrations from Q2 2020 include:

- Sygnum Bank, the first fully regulated crypto bank, added XRP to its highly regulated custody solution and financial platform.

- Similarly, Zero Hash integrated XRP to its settlement platform, allowing digital asset businesses to access U.S. markets. Zero Hash is a division of Seed CX, a registered CFTC swap execution facility and holder of a New York Department of Financial Services BitLicense.

- Swisscom Blockchain, one of the largest telecommunications providers in Europe, successfully launched XRP on its DAPPI platform, enabling enterprise-grade access to the XRP Ledger for a wide array of use cases.

Ripple hopes to see a continued evolution of XRP infrastructure over the coming months, particularly in the derivatives space, that will further solidify XRP as a top three digital asset, adding to its robustness and liquidity.

Liquidity and Volume

As for overall liquidity and volume, XRP ended the quarter as the fifth most traded digital asset as measured by rolling 30D volume. XRP volume remained relatively strong as overall digital asset volume saw a dip in the second quarter of 2020. The XRP Ledger saw over 85 million in total transactions and XRP’s adjusted transfer value (NVT) ratio was 200.512—the highest among all digital assets in Q2. The NVT ratio compares market cap to on-chain transactional usage, making it a good determination of an asset’s utility. XRPL also saw $20,138 in total transaction fees over the ledger—the lowest among all digital assets in Q2.

XRP is useful for the movement of trading collateral across venues amid an increasingly fragmented crypto infrastructure. As highlighted in the last report, and separately in this blog post, XRP is less costly, more reliable and faster than other assets. There is evidence of an increase in cross-exchange transfers using XRP over peer coins during the market stress caused by COVID-19 in early March 2020. Ripple firmly believes in XRP’s capacity to help bring efficiency into the digital assets markets similar to how it brings efficiency to a fragmented global payments market.

Xpring

In June, RippleX, Ripple’s open developer platform for money, joined over 46+ companies including Blockchain.com, BitPay, Brave, Flutterwave, BitGo, GoPay, Care and Mercy Corps to unveil PayString—a universal payment ID to simplify the process of sending and receiving money globally, across any payment network and currency, including XRP. The companies collaborated on the development of the open-source solution through the Open Payments Coalition, which jointly reaches over 100 million consumers.

Market Commentary

Regulatory Activity

- The Office of Comptroller of the Currency (OCC) nominated Brian Brooks as the acting Comptroller. Brooks plans to unveil a new payments charter, hoping to create a single federal framework for tech firms to offer services traditionally offered by banks. The OCC also issued an Advanced Notice of Proposed Rulemaking, soliciting comments on, among other things, adoption of crypto-related activities by U.S. banks.

- Former CFTC Chairman J. Christopher Giancarlo published a paper explaining why XRP should not be considered a security under U.S. law and judicial precedent. He is also spearheading The Digital Dollar Project which published a white paper on its proposal for a joint public-private initiative to create a U.S. central bank digital currency (CBDC).

- The Consumer Finance Protection Bureau (CFPB) published its final remittance rule including how digital assets, specifically XRP through ODL, can help significantly lower the cost of cross-border remittances.

- The Indian Ministry of Finance proposed to legally ban cryptocurrencies and impose stiff penalties on citizens who use cryptocurrency. This follows earlier action by India’s Reserve Bank issuing a clarifying statement that India’s commercial banks may provide banking services to traders and firms dealing in cryptocurrencies.

- The Intergovernmental Financial Working Group (IFWG) of South Africa released a position paper that proposes a strict crypto policy framework for the region.

- SEC Commissioner Hester Peirce was nominated for another five year term at the securities agency. Caroline Crenshaw was also nominated to fill a Democratic vacancy on the Commission. Their confirmation hearings were scheduled for July 2020.

- The EU is looking to create a new regulatory regime for digital assets, covering unregulated assets to stablecoins.

Market Moves

- Macro investor Paul Tudor Jones bought Bitcoin as a hedge against inflation, and said his fund may hold as much as a low single-digit percentage of its assets in Bitcoin futures.

- JPMorgan offered bank accounts to cryptocurrency exchanges beginning with Gemini and Coinbase.

- Of nearly 800 institutional respondents to a Fidelity survey, 36% said they owned either digital assets or derivatives.

- New York’s Department of Financial Services granted BitLicense to Eris X.

- Users withdrew over $220 million in BTC from exchanges before and soon after the May halving.

Industry Players

- China completed the backend architecture development of its digital yuan. The rapid development of the digital yuan spurred headlines around China’s potential heavy influence and leadership in the payments industry.

- The People’s Bank of China (PBOC) announced a pilot program to trial its new digital yuan with 19 local businesses, including U.S. chains Starbucks, Subway and McDonald’s.

- PayPal and Venmo plan to add crypto buying and selling to their platforms.

- Brazil suspended the WhatsApp payments service, just a week after the initial roll out.

- Visa signed a partnership deal with Safaricom’s M-Pesa.

- Binance launched a crypto payments app in Nigeria.

- Revolut announced it is making cryptocurrency available to all its seven million customers.

The post Q2 2020 XRP Markets Report appeared first on Ripple.