Tens of thousands of crypto traders are having their positions liquidated as markets across numerous sectors close out the week in the red.

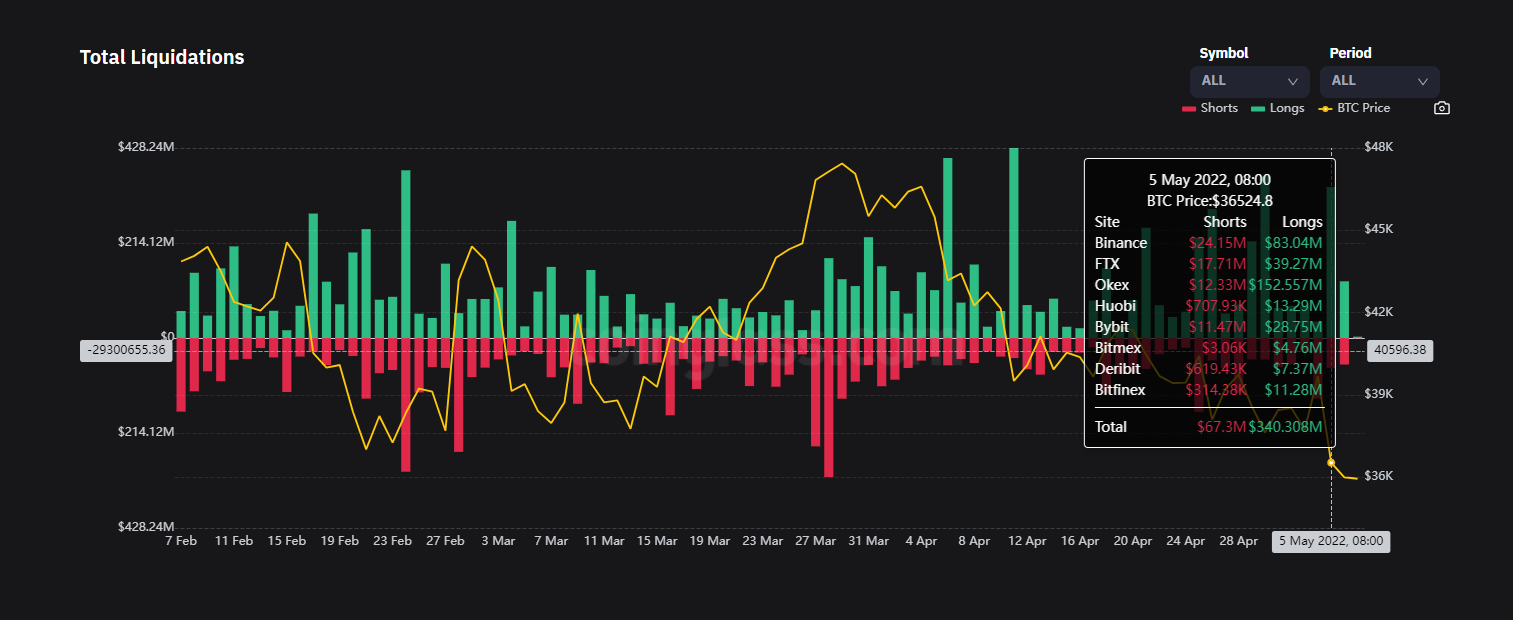

Data from the cryptocurrency futures trading and information platform Coinglass reveals that on May 5th, more than $407.60 million worth of trader positions in digital assets were wiped out in a 24-hour span.

Among these losses, over $340.30 million worth of long positions were wiped out. Those who betted on the sustained drop of the crypto markets were also not spared by the volatility as $67.3 million worth of short positions were liquidated on the same day.

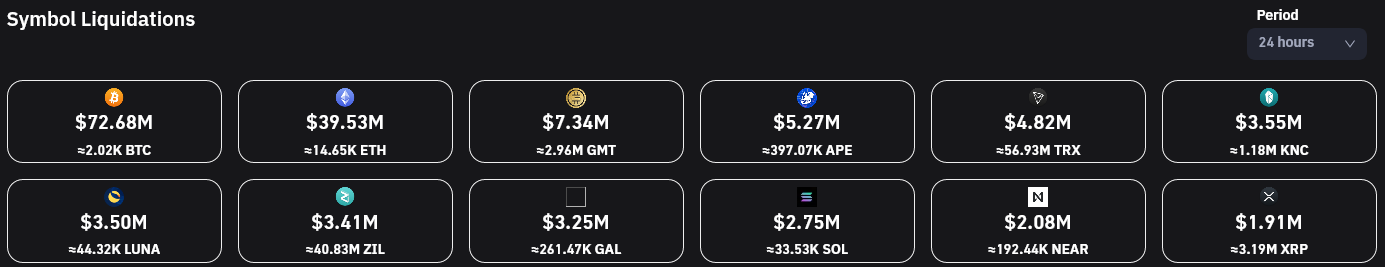

As the crypto markets continue to tumble, some of the biggest liquidations from Thursday into Friday came at the expense of Bitcoin (BTC) traders. More than 2,000 BTC worth $72.7 million were liquidated over a 24-hour period followed by Ethereum (ETH) at $39.53 million.

A pair of newer altcoins that had seen big rallies of late were not spared by the carnage as traders of the fitness app STEPN (GMT) and Yuga Labs’ ApeCoin (APE) witnessed liquidations to the tune of $7.36 million and $5.27 million, respectively.

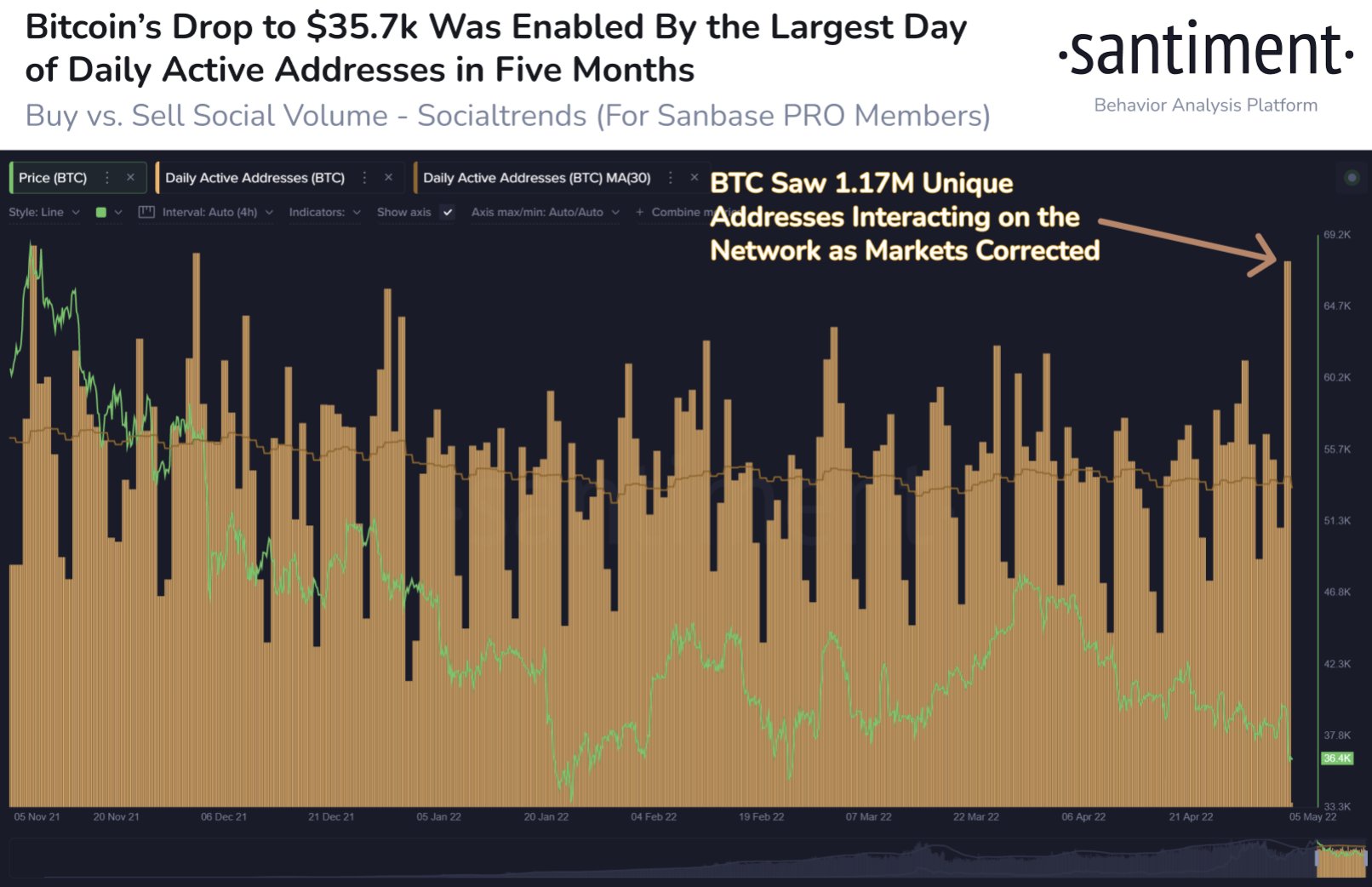

Analytics firm Santiment is also weighing in on the crash, highlighting that this week’s correction marks one of the largest capitulation events for BTC in the past year.

“Bitcoin is seeing its third-largest capitulation week in over a year, in terms of its ratio of on-chain transactions taken at a loss.

The last time BTC was this far negative for this metric was Feb. 16th-22nd, when prices jumped +20% the following 9 days.”

The firm also notes that BTC witnessed a massive amount of on-chain activity amid the crypto market pullback.

“After yesterday’s mid-sized correction, the dust is still settling across crypto markets. Bitcoin’s network had 1.17 million unique active addresses making transactions yesterday, which was the highest amount of utility since December 2nd, 2021.”

Bitcoin is currently trading sideways at $36,074 but remains down 9.6% from its weekly high of $39,874 on Wednesday.

Ethereum is currently valued at $2,699, down 8.7% from its May 4th peak of $2,955.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Malyutin Nikita/Natalia Siiatovskaia