The Ethereum (ETH) network has been experiencing high demand, as evidenced by an uptick in transfers and average gas fees.

On-chain metrics provider Santiment explained:

“With ETH transfer demand increasing, the amount of average gas used (in gwei) has risen sharply to 132.53 per transfer. This is a 3-month high in average gas fees.”

Crypto analytic firm Glassnode noted that the fees averaged $22.52, which signalled a 90-day high.

Previously, the Ethereum network grappled with the high fee challenge that proved detrimental to the average trader. Nevertheless, the continuously incorporated upgrades, such as the London Hardfork and Ethereum 2.0, are expected to handle this problem.

Recently, Ethereum’s perpetual swaps of open interest crossed the $8 billion mark for the first time since May. It, therefore, showed that Ethereum’s price and open interest were strongly correlated.

Total value locked in ETH 2.0 reach an ATH

According to Glassnode:

“Total value in the Ethereum 2.0 deposit contract just reached an ATH of 7,163,426 ETH.”

Ethereum 2.0, also known as the Beacon Chain, was launched in December 2020 and was regarded as a game-changer that sought to transit the current proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) framework.

The proof-of-stake algorithm allows the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle. As a result, it is touted to be more environmentally friendly and cost-effective. ETH 2.0 is also expected to improve scalability through sharding.

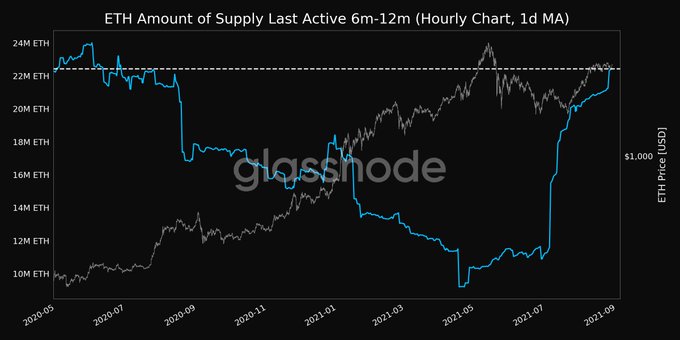

Leading US-based crypto exchange Kraken recently revealed it had donated $250,000 to help open-source developer teams tasked with the ETH 2.0 upgrade. Meanwhile, Ethereum supply last active between six and twelve months reached a 14-month high of 22,432,181 ETH.

This shows more Ethereum was being liquidated because it was being transferred from cold storage and digital wallets to crypto exchanges.

Image source: Shutterstock