Today sees the Bitcoin bulls mounting a fightback following the weekend slide. Although the leading cryptocurrency is up a relatively modest 3%, it’s still welcome news considering the pain of last week’s sell-off.

Despite recent turbulence, Bitcoin’s macro performance has been nothing short of remarkable since the end of Q3 2020. While the lead up to this period saw many months in and around $10k, the end of October 2020 was when things really started to take off.

Over this period, Bitcoin posted near 300% gains before topping at $42k. What was particularly special about this was the move’s speed and strength, which forced the crypto skeptics to second-guess their position.

On that, Marcus Swanepoel, the Chief Executive of crypto exchange Luno, said:

“Even the most bullish of bitcoin advocates could not have foreseen such a meteoric rise in price in such a short space of time.”

Since the rejection at $42k, a sense of normality has returned. With that comes the opportunity to assess the impact of the run-up in relation to other metrics.

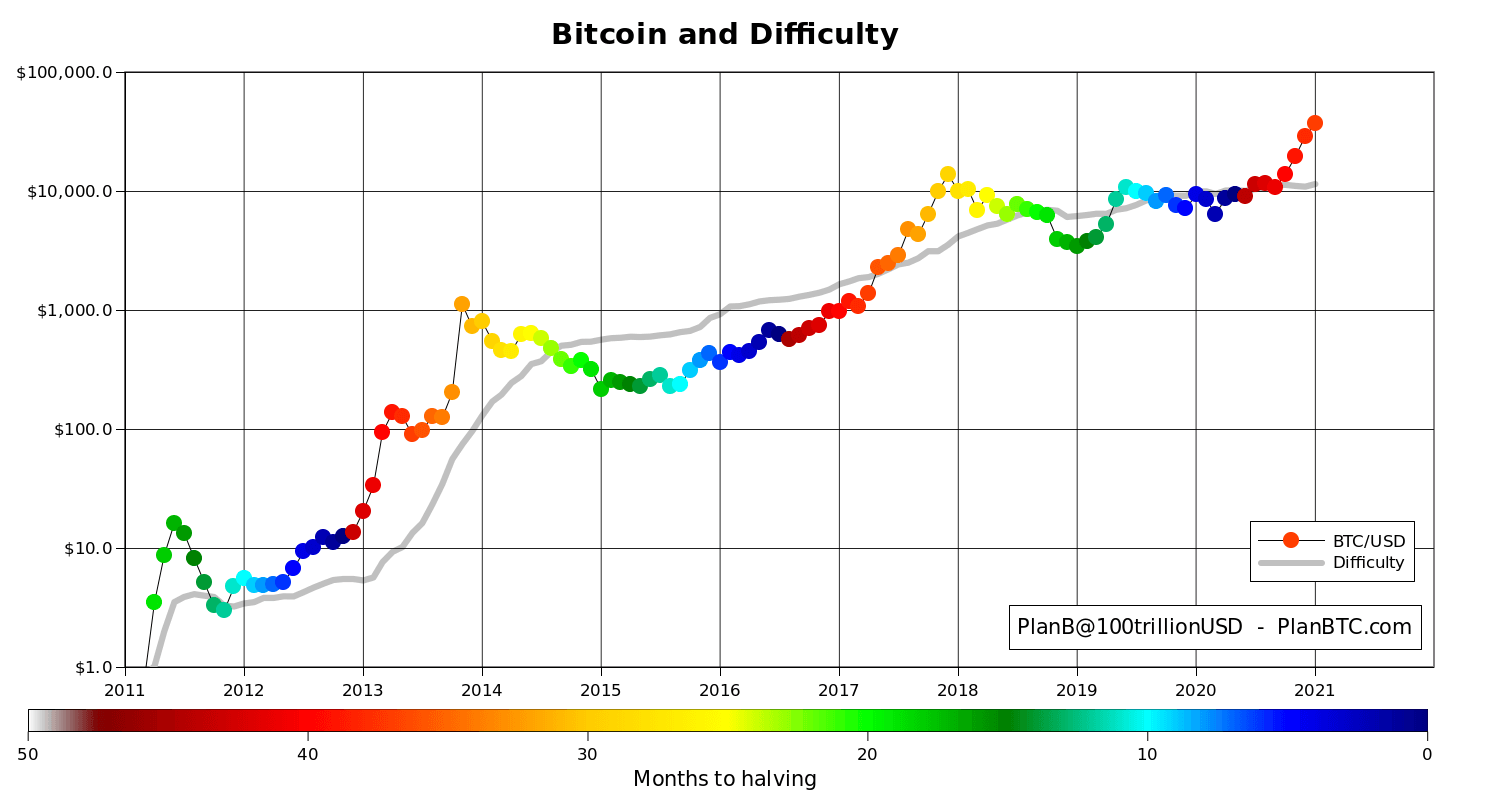

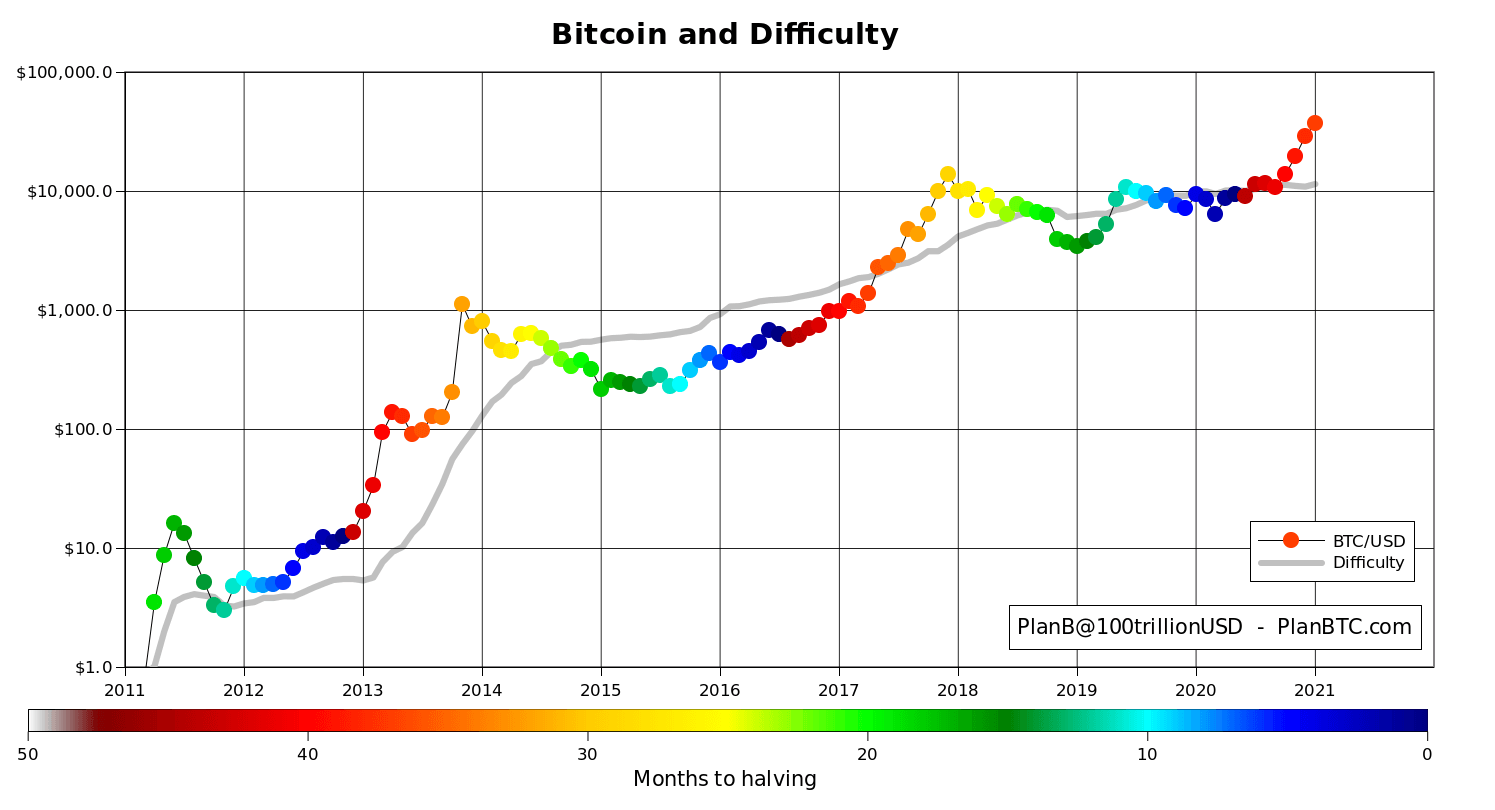

On that Twitter analyst, @100trillionUSD noted that mining difficulty remained comparatively flat despite the exponential gains over this period.

In the past, mining difficulty increased as the Bitcoin price increased. The most notable example of this relationship is shown in the chart below, in 2013. During this time, mining difficulty saw a steep rise as BTC went from just over $10 to $1,000.

What is happening with Bitcoin mining difficulty?

Bitcoin mining difficulty is a measure of how hard it is to mine a Bitcoin block. High mining difficulty means it will take more computing power to mine the same number of blocks.

The difficulty is adjusted algorithmically every 2,016 blocks, which comes around approximately every two weeks.

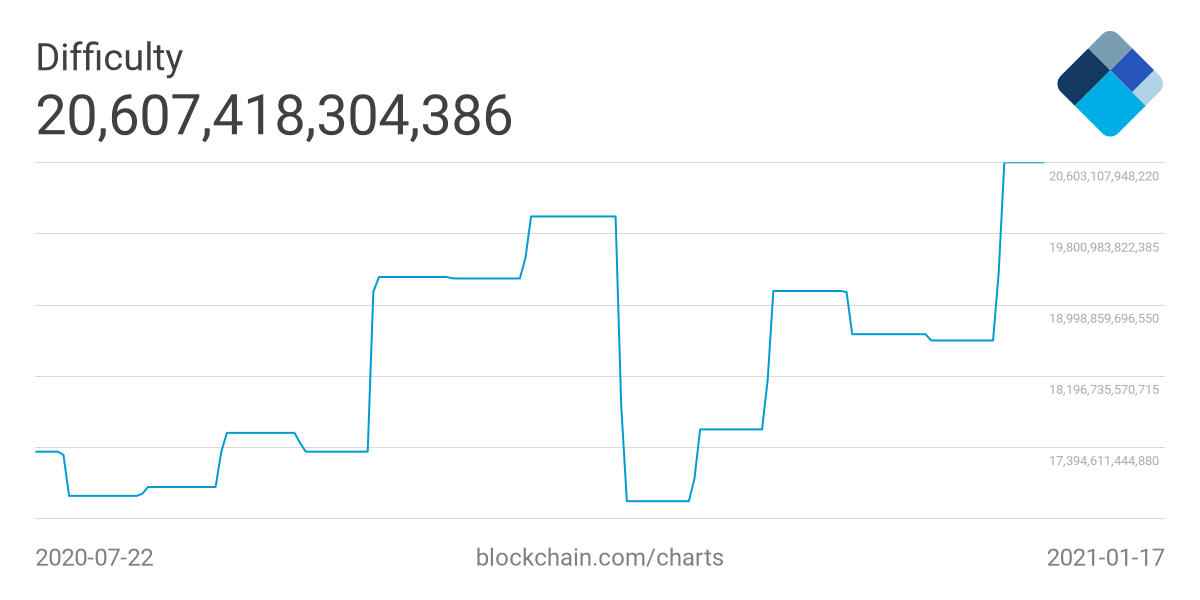

A more detailed analysis shows mining difficulty at the start of October 2020 was 19.32 t. Although this dipped to as low as 16.79 t going into November, difficulty re-adjusted upwards at the end of the year, to 18.6 t.

Over the course of January 2021, as the difficulty became harder, it led to a current difficulty of 20.61 t.

But all the same, a swing of 3 t is a relatively stagnant level of difficulty adjustment, especially considering the $32k swing in price over the same period.

This suggests that new miners are not joining the network despite increased profitability. We would expect to see mining difficulty increase much more to reflect the increased competition if they were.

Bitmain’s official website shows its AntMiner S19 Pro, S19, and T19 are all sold out until August 2021.

Likewise, it’s a similar story at MicroBT, but with no indication of when products are back in stock.

As such, an ASIC miners supply shortage is likely the reason why mining difficulty remains flat relative to price.

The post Data shows Bitcoin mining difficulty flat despite near 300% gains in price appeared first on CryptoSlate.