An altcoin that helps holders earn yields is lapping the field as the crypto markets try to recover from a difficult month.

Yearn.Finance (YFI) is a decentralized finance (DeFi) protocol that offers lending and trading services so users can optimize their crypto asset earnings.

The YFI token’s price has been on fire over the past week, more than doubling from $18,867 on December 15th to a high of $39,353 on December 20th.

The altcoin first got a boost last week as word spread that Yearn had gone on a major shopping spree buying back its own token.

Yearn tweeted that it had purchased over $7.5 million worth of YFI, adding that its treasury was armed with $45 million with the intention of buying more tokens in the future.

Yearn’s price continues to surge as the community now considers a change in YFI’s tokenomics.

At the top of the list is the suggestion that token holders active in Yearn governance be rewarded with a portion of buybacks.

Yearn says in a tweet,

“Tokenomics, rewarding YFI holders with the… token buybacks, diluting paper hands for the benefit of the blue-pilled diamond hands.”

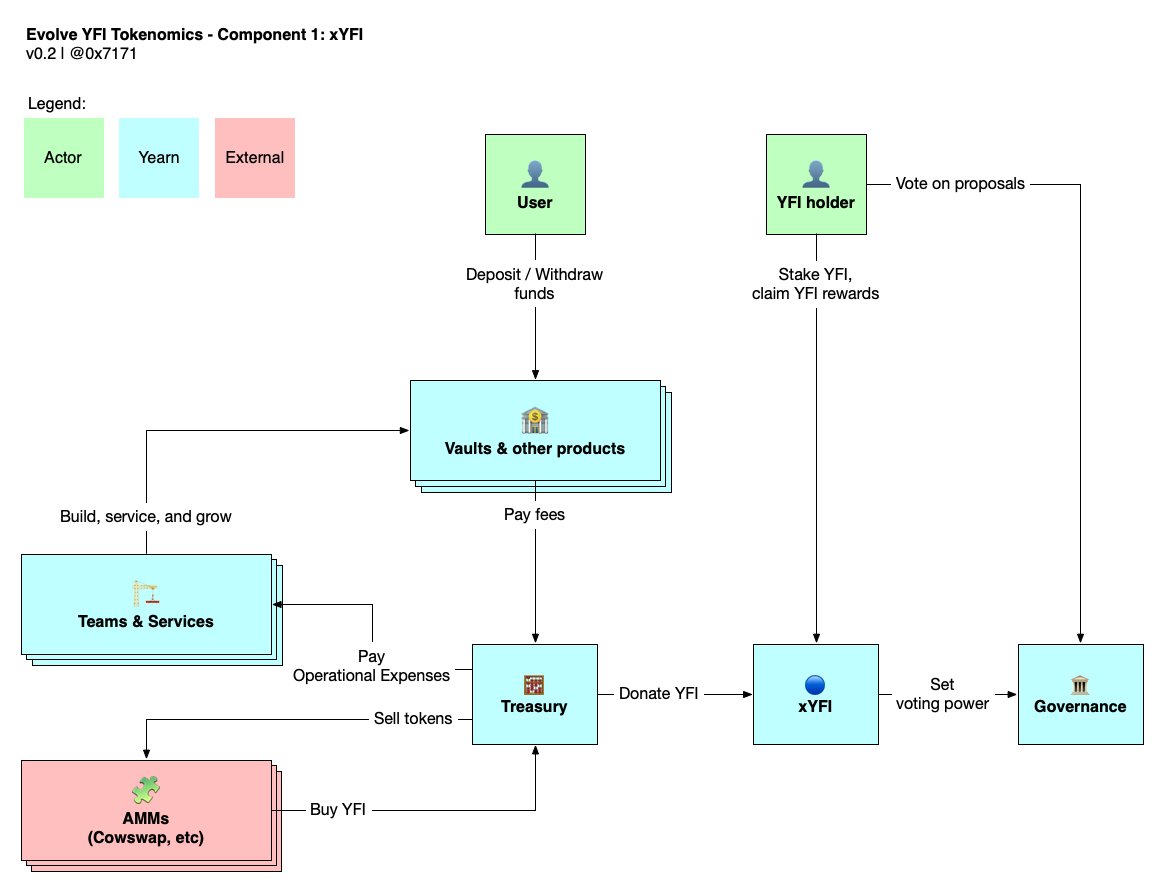

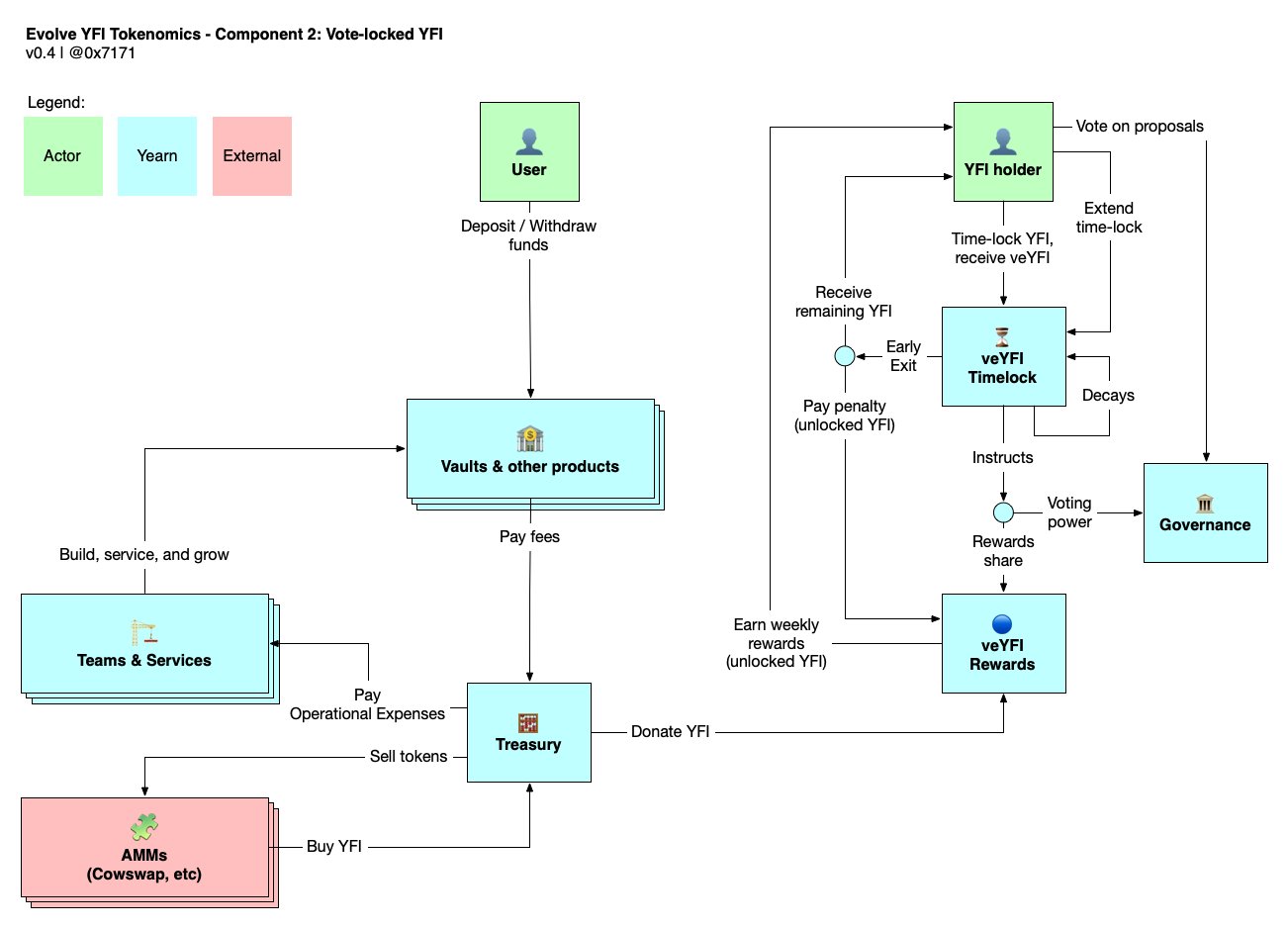

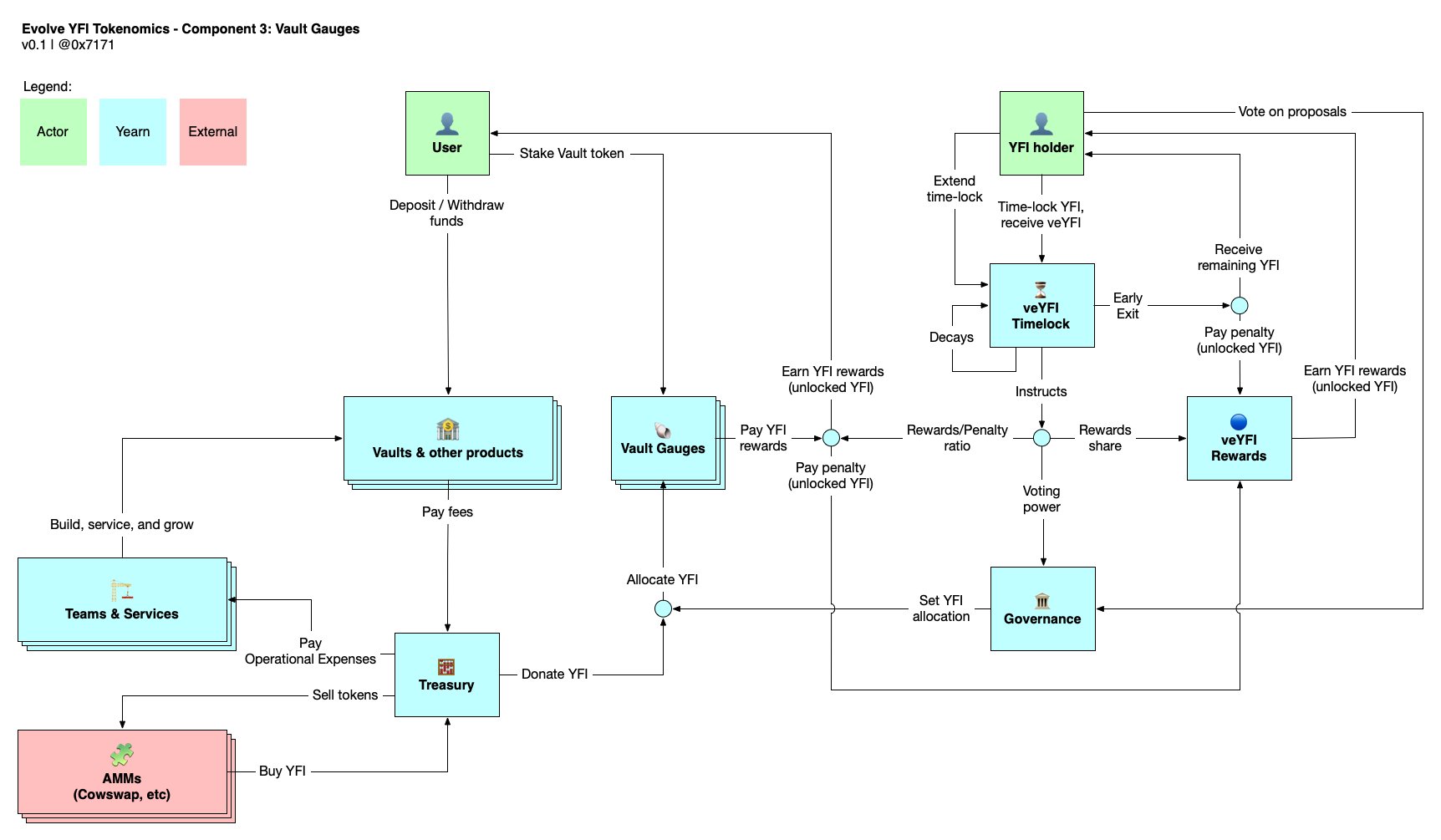

Next is a four-stage proposal involving a combination of rewards, locking tokens in vaults for set periods of time, and credit for performing useful work.

The process is outlined in a series of illustrated tweets.

“Step 1: xYFI. Stake in the xYFI vault, earn bought back YFI from the treasury. Simple as that.”

“Step 2: veYFI. Vote-lock YFI, with decay and time extension. Max-lock and earn disproportionate rewards compared to those who lock for a shorter duration. Early exit any time but pay a penalty to the other stakers.”

“Step 3: Vault gauges. Stake your yVault token in a gauge, earn YFI rewards, boosted by how much veYFI you have staked. Vote on which vaults should get allocated rewards. Pay a penalty to other stakers if you don’t have a strong enough lock.”

Step four involves engaging in “useful work,” which could include “configuring vault parameters, setting fees, providing insurance.”

At time of writing, YFI is down 9.25% on the day and trading for $34,553.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Anusorn Nakdee/Andy Chipus