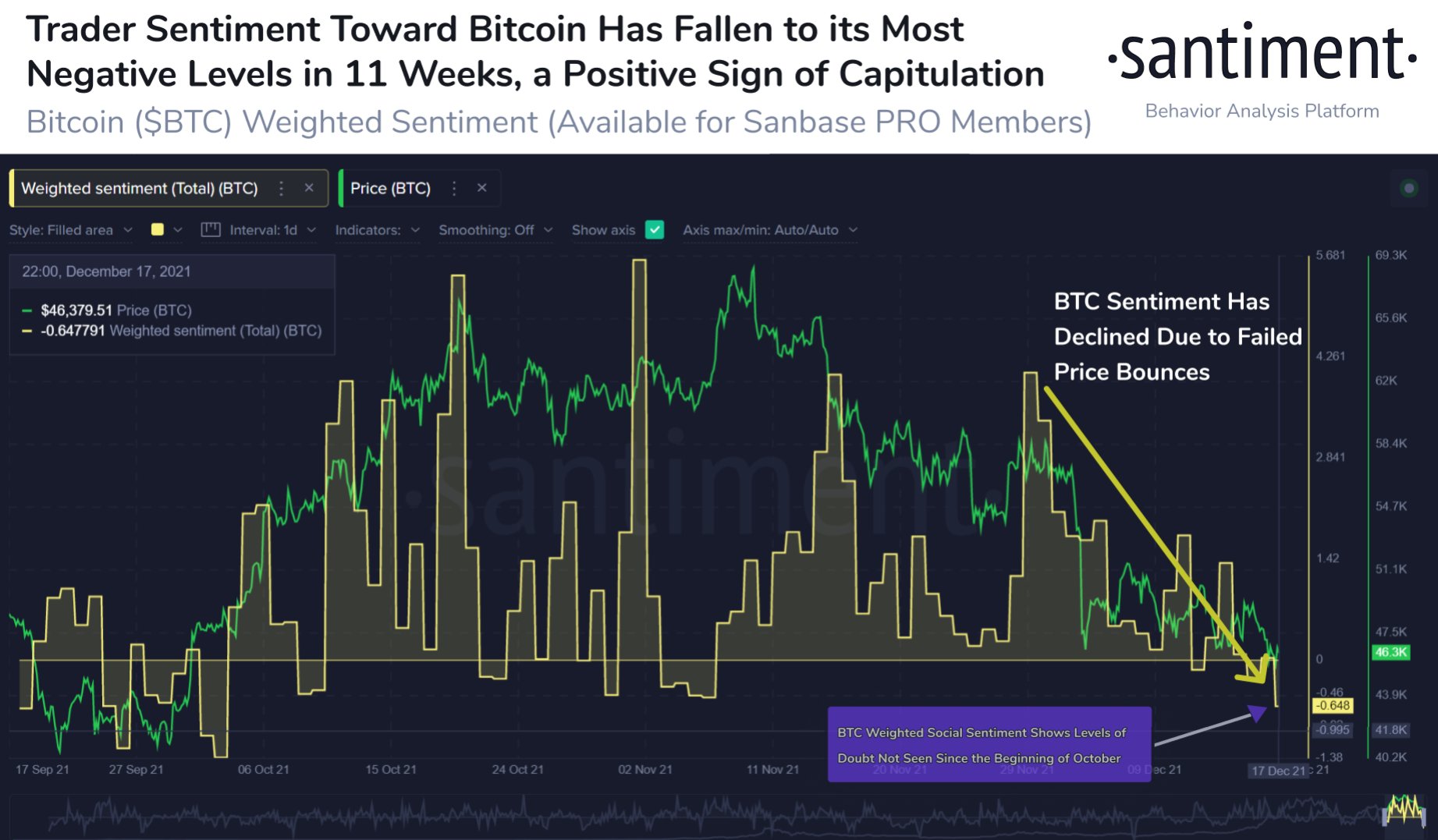

Crypto insights firm Santiment is examining the sentiment of Bitcoin traders to determine whether the leading crypto asset is close to carving a bottom.

The analytics company tells its 119,200 Twitter followers that sentiment among Bitcoin traders has fallen to a level not seen in three months, indicating that market participants have started to capitulate.

“We’re seeing signs of Bitcoin capitulation after prices have remained below $50,000 for the past six days, and majority of December. This is the most negative trader commentary since early October, a good sign prices can finally bounce after all the FUD (fear, uncertainty and doubt).”

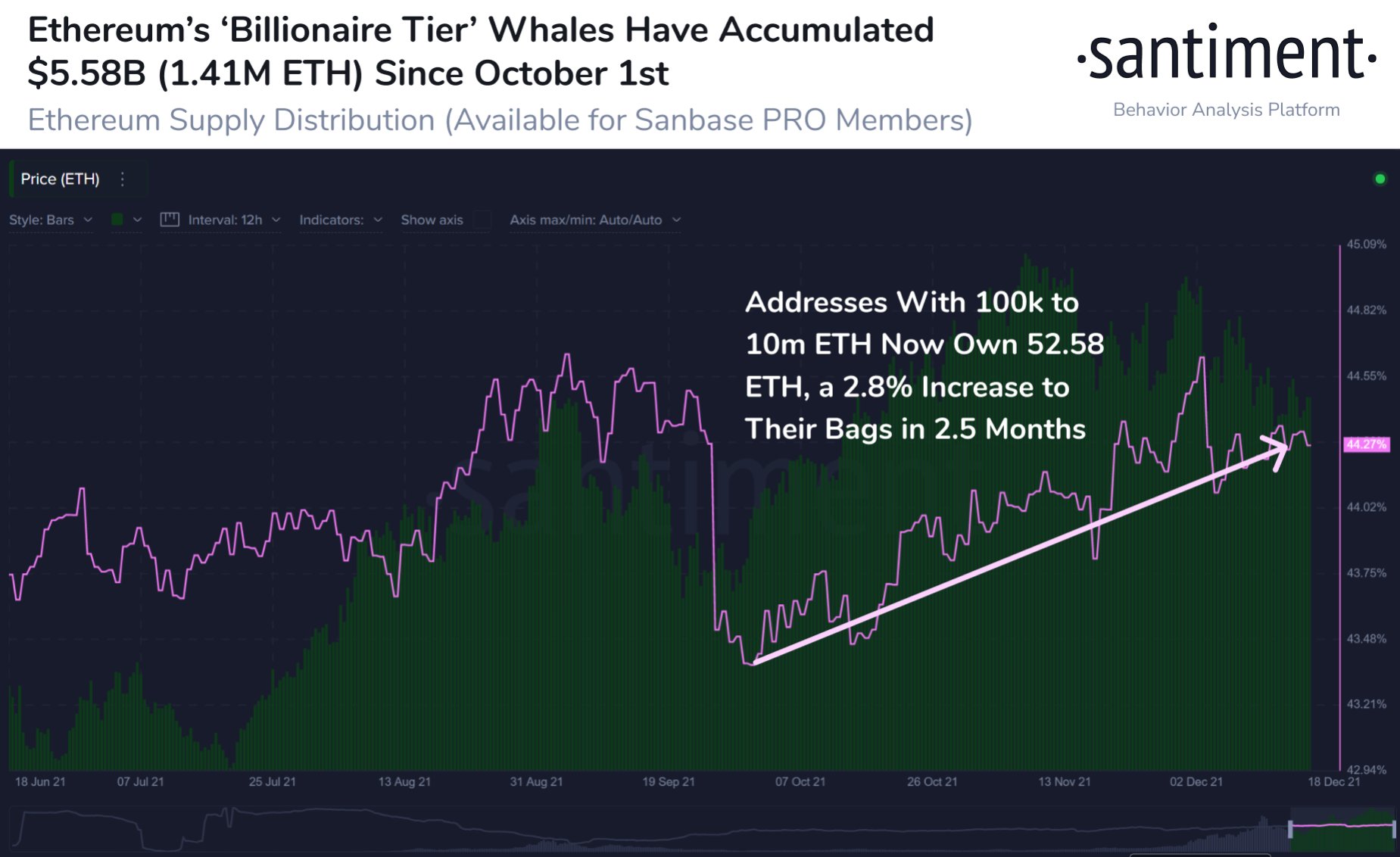

As for Ethereum, Santiment says that the largest ETH whales continue to accumulate the leading smart contract platform regardless of market conditions.

“Ethereum’s price sits at ~$3,970 as whale behavior continues to play an important role. Billionaire addresses with 100,000 to 10 million ETH have accumulated $5.58 billion [worth] of ETH (1.41 million coins) since Oct 1st, adding 2.8% more to their bags in these past ~2.5 months.”

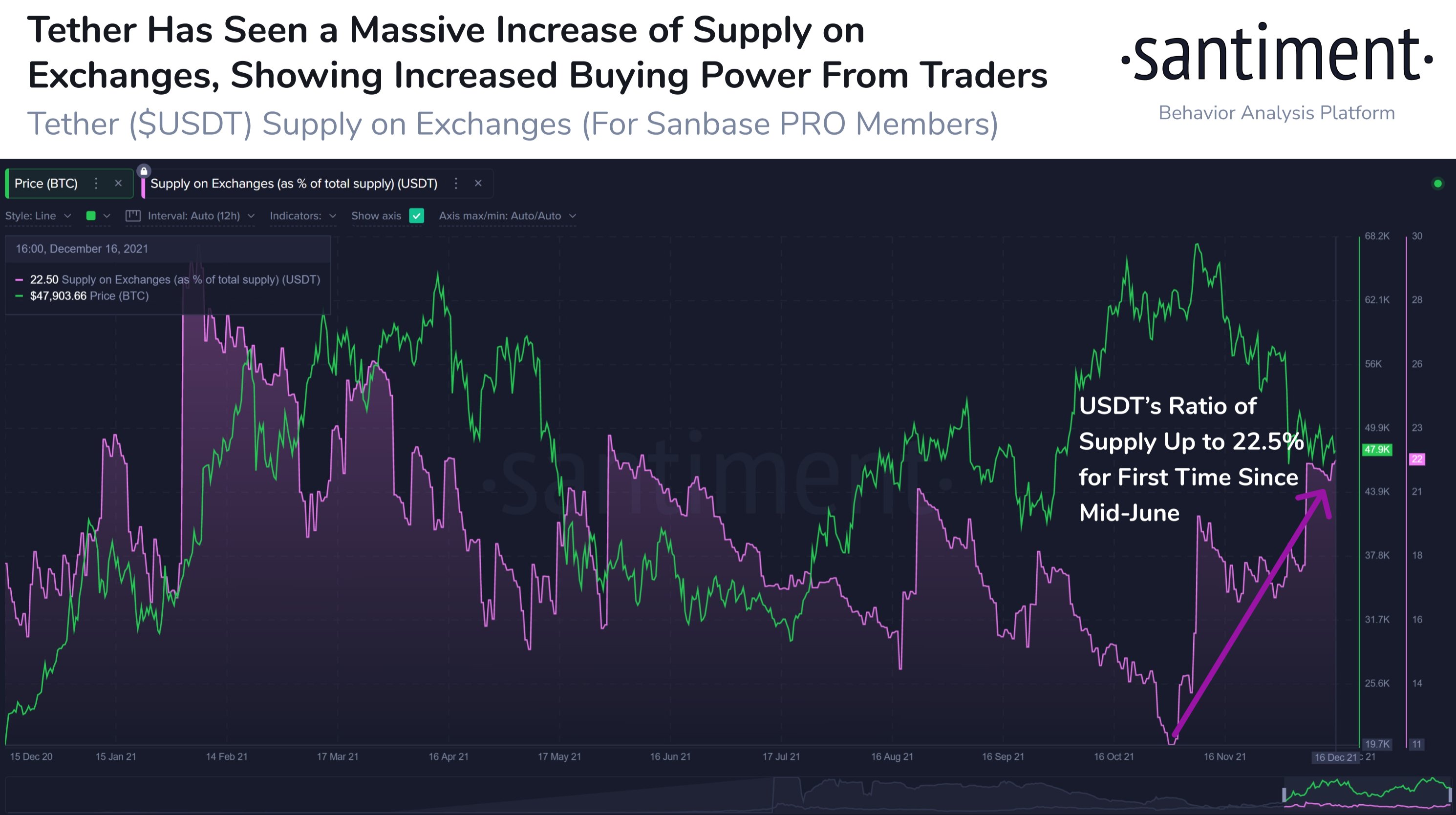

Santiment is also keeping a close watch on the flow of stablecoin Tether (USDT) to crypto exchanges. According to the crypto insights firm, investors are preparing dry powder amid the sustained correction in the digital asset market.

“The ratio of Tether stablecoins on exchanges has risen to 22.5%, which is the highest level in over six months. This amount of supply converts to $8.99 billion, indicating a rising level of buying power accumulating on exchanges.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tuso chakma/solarseven